India Abolishes Angel Tax on Foreign Investments to Boost Start-Up Ecosystem and Innovation

India Abolishes Angel Tax on Foreign Investments to Boost Start-Up Ecosystem and Innovation

In a significant move to support India's start-up ecosystem, Finance Minister Nirmala Sitharaman announced the removal of the angel tax on foreign investments in start-ups. This decision, expected to ease funding challenges for start-ups, was highlighted as a step to boost innovation and entrepreneurial spirit in the country.

The angel tax, originally introduced during the UPA regime to curb money laundering, was criticized for hindering foreign investment and stalling start-up growth.

Revenue Secretary Sanjay Malhotra assured that existing laws, including the Prevention of Money Laundering Act, would still address any concerns about fund sources. The abolition of the tax is seen as a positive development by industry stakeholders, including NASSCOM and Auxano Capital, who believe it will prevent fresh litigation and release funds tied up in legal disputes.

The decision comes at a crucial time, as start-up funding in India fell by 60% to $10 billion in 2023.

The tax had imposed burdens during critical early stages of start-up development, deterring growth. Despite previous resistance from stakeholders and recent income tax rule amendments, the government maintained the tax until now.

This removal aims to provide tax certainty and support for both domestic and foreign investors in the start-up sector.

what is angel tax?

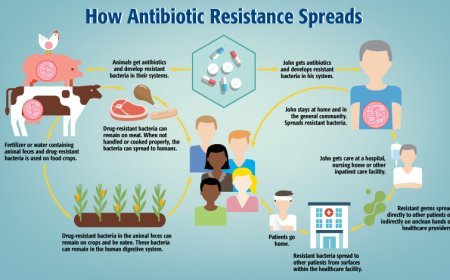

Angel tax is a term used to describe a tax levied on the capital raised by unlisted companies through the issue of shares to investors, particularly when the share price is deemed higher than the fair market value. This tax was introduced to prevent money laundering, where funds of dubious origin could be disguised as legitimate investments in overvalued companies.

In India, the angel tax was first introduced in 2012 as part of the Income Tax Act under Section 56(2)(viib). The tax applied to funds received by a company from an Indian resident as an investment, with the difference between the investment amount and the fair market value being treated as income and taxed accordingly. This policy was intended to curb the practice of laundering money through inflated share valuations in unlisted companies, often referred to as "angel investments."

However, the angel tax faced criticism from start-ups and investors, as it created tax liabilities even when investments were based on potential future value rather than current market worth. This was seen as a deterrent to genuine investment and growth in the start-up sector, leading to calls for its abolition or modification.

What's Your Reaction?